In Running Your Business

Follow this topic

Bookmark

Record learning outcomes

The NHS Business Services Authority (NHSBSA) report on the provision of general pharmaceutical services between 2015/16 and 2021/22 paints a picture that will not surprise pharmacy contractors.

During 2021/22, there were 11,522 active community pharmacies and 111 active appliance contractors, the lowest number of active contractors since 2015/16. From a peak in 2017/18 of 11,972 community pharmacies, numbers have declined in each year since, although fewer pharmacies overall were lost in 2021/22 (114) compared to 2020/21 (190).

Interestingly, there were more independent contractors (defined by NHSBSA as five pharmacies or fewer) in 2021/22 than a year earlier (4,743 rather than 4,679), meaning 160 fewer multiples (six pharmacies or more). With most of the larger groups announcing closures or divesting pharmacies over the last couple of years, we can expect to see this balance shift further in 2022/23. Distance selling pharmacy numbers appear to be stable at around 375.

Item data disected

Some 1.04 billion prescription items were dispensed by community pharmacies in 2021/22, a 2.59 per cent year-on-year increase. The Electronic Prescription Service accounted for just over four million prescription items short of one billion; 95.3 per cent were dispensed by EPS.

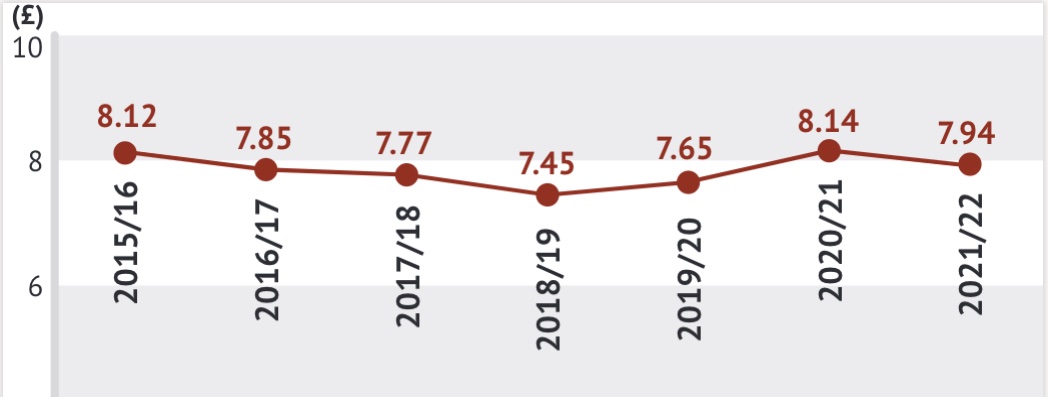

The average number of items dispensed per pharmacy in 2021/22 was just short of 81,000 – up from 78,000 a year earlier. Fees received were up proportionately, from 88,300 in 2020/21 to 91,700. After two years of increases, the average cost of an item, per fee received, dropped to £7.94. (Figure 1).

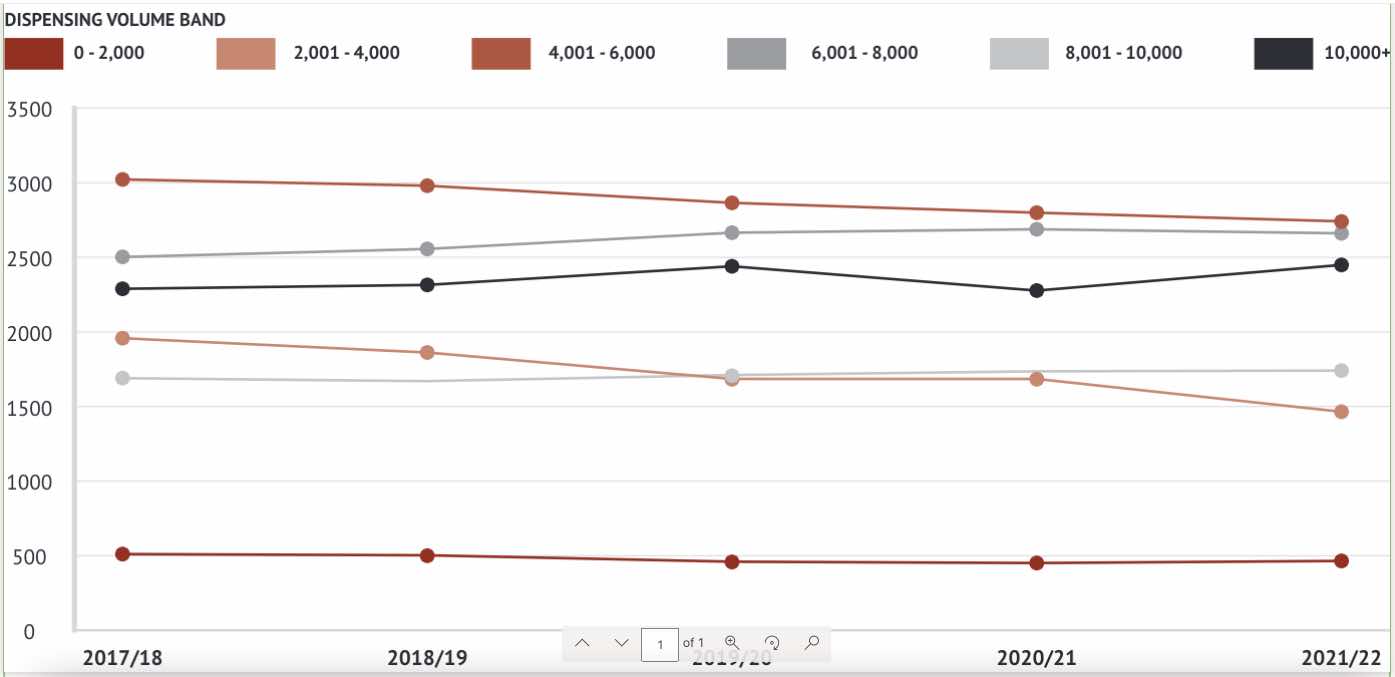

When looking at dispensing volume, the clear trends we reported on in 2019 have continued, with the number of pharmacies in the lower dispensing volume bands falling, while the number doing more are increasing (Figure 2).

Service income switch

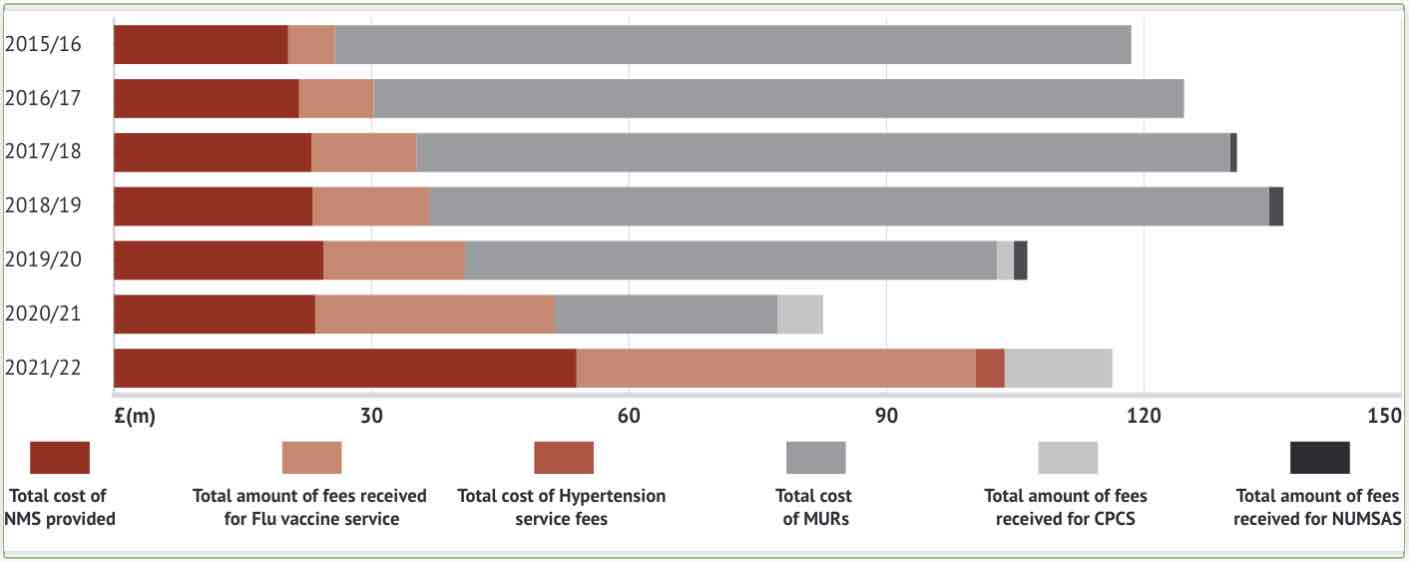

More positively, the 2021/22 report reveals, starkly, the growth in fees paid for clinical services delivered, including the impact in two switches in the focus of provision, from MURs (abolished) to the New Medicine Service (where the cap on claims was lifted) and from the NHS urgent medicines service, which became part of the Community Pharmacist Consultation Service (CPCS). Claims relating to Covid are also covered in the report (Figure 3).

The number of vaccines administered by pharmacies as part of the NHS Flu Vaccination Service has increased by more than 700 per cent since the service began in 2015. In 2021/22, 4.85 million vaccines were administered by 9,860 community pharmacies at an average of 492 vaccines per pharmacy – an increase of 75 per cent on the previous year. The value of fees paid to pharmacies for delivering the service has increased more than eight times between 2015/16 and 2021/22, from £5.44m to £46.5m.

The number of New Medicine Services claimed in 2021/22 was up by 125 per cent year-on-year, to 2.1m at total fees of £53.9m, while total CPCS fees across all referral pathways were up 81 per cent year-on-year to £12.6m (drug costs were also up 81 per cent, with £2.84m claimed in 2021/22).

Turning to Covid-related payments, a total of 456,000 £6 claims were made for the Community Pharmacy Home Delivery Service at a total cost of £2.74m, while £66m was paid out in fees for the Community Pharmacy Covid-19 Lateral Flow Device Distribution Service. The total cost of fees for Covid vaccinations provided by community pharmacy contractors was £334m, with a peak during the Autumn of 2021 as phase three vaccinations were rolled out.

Business confidence down

The prospect of mounting financial pressures and the growing reach of online pharmacies are making pharmacists less confident in the sector than they were a year ago, according to the latest Lloyds Bank Healthcare Confidence Index for 2022/23.

Each year, Lloyds Bank asks pharmacists, dentists and GPs to rate how confident they are in the health of their business over the next 12 months and in five years’ time. This year, pharmacists gave a composite score of -7, down from last year’s record high, but still underwater, of -4.

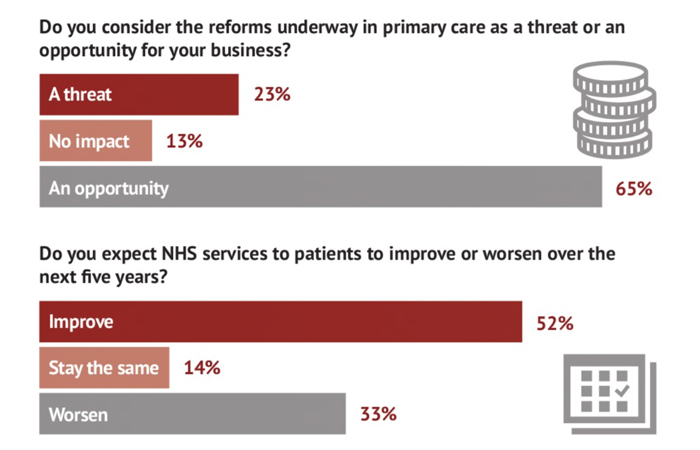

Short-term confidence was up slightly from 27 to 29, with 46 per cent of pharmacists expecting their profits to grow in the next year (down from 65 per cent a year ago), although 52 per cent anticipate an uptick in NHS services (Figure 4). However, with ongoing shortages of medicines and rising energy prices front of mind, 71 per cent flagged inflation and 58 per cent supply chain disruption as key challenges for 2023.

There is evidence that the trajectories of some of the key drivers for the sector are still not resonating. In spite of the push to services, only two in five pharmacists expect the proportion of script-related income in their businesses to fall over the next five years, while fewer than half (46 per cent) said they were unaware of the UK’s net zero target, and only 29 per cent were taking action to make their premises more energy efficient.

On the more positive side, for the fourth year in a row, the number of respondents who say they would encourage family and friends to consider pharmacy as a career is up, to 72 per cent. With 65 per cent suggesting reforms across primary care are an opportunity, it would seem clinical services are a popular direction of travel.